Natalie Choate’s Recommended Books

Of course you should buy my books Life and Death Planning for Retirement Benefits and The QPRT Manual. Here are the books by OTHER authors that I highly recommend.

For Everybody…

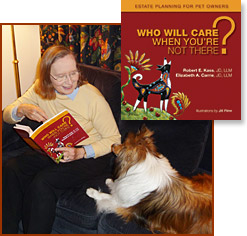

Natalie and Thorfinn study Who Will Care When You’e Not There?

New recommended book! Who Will Care When You’re Not There?

If you own a pet, or you have any client who owns a pet, you must buy immediately, read tonight, and implement tomorrow Who Will Care When You’re Not There? by top estate planner and best-selling author Robert Kass, Esq.

Well written like all Bob’s stuff, this book tells you what you need to put in place via your estate plan to provide for your family pet. It includes a guide to all 50 states’ laws on “pet trusts” plus forms and everything else you need to take care of this often-overlooked step. $24.95 on Amazon.com.

For the Nonprofessional Reader…

Ed Slott’s Books

If you have been looking for good books for nonprofessionals on retirement distribution planning, you’ve found them: Ed Slott has written three. All are written in Ed’s highly readable and unintimidating style, contain excellent information and advice, and should motivate the clients to do the right thing. The newest is Your Complete Retirement Planning Road Map (Ballentine Books, 2007). It’s probably the best one because it condenses EVERYTHING into a series of action checklists. The other two are classics too: Parlay Your IRA into a Family Fortune (Viking, 2005) and The Retirement Savings Time Bomb and How to Defuse It (Viking 2003). All are available at Amazon.com.

IRAs, 401(k)s & Other Retirement Plans: Taking Your Money Out

Another good book on retirement benefits for nonprofessionals (aimed more at the do-it-yourselfer, whereas Ed’s book encourages readers to seek professional advice) is IRAs, 401(k)s & Other Retirement Plans: Taking Your Money Out, by Twila Slesnick, PhD, Enrolled Agent, and Attorney John C. Suttle, CPA The authors not only know their stuff, they put great thought and care into producing a user-friendly book. Example: each chapter begins with “who should read this chapter,” and contains its own mini-glossary. Your clients will love it. I wish I had written it. Nolo Press. Newest edition is 2007. Amazon.com.

Women & Money: A Practical Guide to Estate Planning

This book by attorney Patricia M. Annino, is easy to read and packed with good advice for women of all ages and stages— single, married, widowed, divorcing, etc. Colorful stories from Pat’s twenty-plus years of estate planning practice personalize the usually-intimidating legal stuff, as she covers life insurance, disability, caring for parents and children, everything. Highly recommended for female clients trying to come to grips with estate planning. $15.99 at Amazon.com.

For Tax and Investment Professionals…

Books About Retirement Benefits and Planning

Attorney’s Guide to the Revised Trust Accounting Rules, With a State by State Analysis of the Law

Seymour “Sy” Goldberg, Esq., CPA, was the first to “preach” the income tax deferral potential of the life expectancy payout, back when the first version of the minimum distribution regulations came out in the 80s. He still does every aspect of planning, administration, and advocacy for retirement plan participants and beneficiaries, but his current cause celebre is the trust accounting rules for retirement benefits. He teaches lawyers and CPAs all over the country, helping to close the malpractice gap that’s out there for trustees who don’t know these rules.

Example: Many states’ laws do not conform to the IRS’s marital deduction requirements regarding the definition of “income” from a retirement plan payable to the trust! If you are a fiduciary or advise fiduciaries, go to http://www.abanet.org/abastore/index.cfm, search “Goldberg,” and download Sy’s Attorney’s Guide to the Revised Trust Accounting Rules, With a State by State Analysis of the Law, for $85.95. This publication could save you a LOT of problems.

A Public Employee’s Guide to Retirement Planning

Anyone who has a 457 plan should get the excellent booklet A Public Employee’s Guide to Retirement Planning by Kathleen Jenks Harm, 2d ed. 2002, ISBN 0-89125-257-6 ($17.00 at Amazon.com), published by ICMA Retirement Corp., Washington, D.C., 800-669-7400.

The Border Guide: A Canadian’s Guide to Living, Working, and Investing in the United States

If you have any Canadian clients who live seasonally in the U.S., or are thinking of moving to or investing in the U.S., you (and they) need The Border Guide: A Canadian’s Guide to Living, Working, and Investing in the United States, by Robert Keats, CFP, of Keats, Connelly and Associates, Phoenix, AZ, ISBN 1-55180-765-3 (8th ed., 2007). In 300+ pages this remarkable book explains the differences between the two nations’ systems of taxation, insurance, and retirement plans, summarizes immigration rules and provides lists of resources. $19.95 at Amazon.com.

The Terrible Truth About Investing

Bruce Temkin’s book The Terrible Truth About Investing has been published to critical acclaim. My blurb for the back cover was almost rejected by the publisher because I just said it was a terrific book about the principles of investing, whereas all the other (more prestigious) reviewers outdid each other comparing the book to Shakespeare, the Bible, etc. Everyone who advises retirees should read this book. Some very prominent financial planners have already changed their investment approach based on this book. It can be purchased by calling Fairfield Press, 1-888-820-5958. Also available through Amazon.com.

Understanding TIAA-CREF

Every estate planner has clients who have TIAA-CREF plans. These retirement plans for university professors are different enough from the standard IRA or 401(k) plan to require specialized knowledge… but until now there was no cost-effective way to get that knowledge. So we can be grateful to Connecticut estate planners Irving S. Schloss, Esq., and Deborah V. Abildsoe, whose book Understanding TIAA-CREF (Oxford Univ. Press 2000; $27.50) is now available through Amazon.com. This book demystifies the settlement options available to TIAA-CREF participants and explains how to fit these benefits into typical estate plans. If you don’t read it, your TIAA-CREF-owning clients will know more than you do, because the “perfessers” are snapping this book up.

J.K. Lasser’s Your Winning Retirement Plan

J.K. Lasser’s Your Winning Retirement Plan, by Henry K. Hebeler. Author Hebeler (former long range planner for a Fortune 500 company) talks tough about the challenge of investing for retirement, pointing out that most of what we read on the subject is written by people with a vested interest in selling us something. After reading his chilling news about the difference between “average” and “compound” returns, why retirees spend less than working folk [hint: it’s not because they positively prefer a simpler lifestyle], and the reality of fees, inflation, volatility and taxes, you may decide to keep working. Available at Amazon.com or any bookstore.

Books About Long-term Care, Medicaid, etc.

How to Protect Your Family’s Assets from Devastating Nursing Home Costs

If you are not an “elder law” specialist but would like to understand the basics of Medicaid qualification; or if you ARE an elder law specialist and would like a resource your clients could read to get up to speed on the subject; I recommend Gabriel Heiser’s book, How to Protect Your Family’s Assets from Devastating Nursing Home Costs (Phylius Press, 2007). This well organized book explains the rules in clear readable English. It does NOT replace the Medicaid lawyer; Gabriel makes clear that there are so many state-specific variations that you must consult an attorney before taking any action. $47 at Amazon.com.

There’s No Place Like (a Nursing) Home

Here’s the book that persuaded me to buy long-term care insurance for myself (and might have the same effect on your clients): There’s No Place Like (a Nursing) Home by Karen Shoff, available at Amazon.com. For those who think they are too wealthy to need LTCI, Shoff points out that the people deciding how much to spend on your nursing home care are (usually) also your heirs. If there’s no LTCI, they may hesitate to spend down your (their future) assets to provide the highest quality custodial care for you… and there is a big difference between top quality care in your own home versus life in the least expensive nursing home. Scary but highly motivating.

Other Great Books You Need

Virtual-Office Tools for a High-Margin Practice

Virtual-Office Tools for a High-Margin Practice tells financial planners how to automate their practices, to improve quality of life, quality of service, and the bottom line. Useful info for all professionals on how to buy scanners and other office equipment. By David J. Drucker and Joel P. Bruckenstein, Bloomberg Press 2002, ISBN 1-57660-123-4. $50 list; or at Amazon.com.

The Self Publishing Manual

I get almost as many questions about self-publishing as I do about retirement plan distributions. If you are an author or would like to be, be sure to read The Self Publishing Manual by Dan Poynter, available in the writer’s reference section of any bookstore or through the website www.parapublishing.com (but cheaper at Amazon.com). I followed Dan’s instructions to the letter in publishing Life and Death Planning for Retirement Benefits. I thank my lucky stars Life and Death was rejected by the only “real” publisher I submitted it to, so I can keep all the profits on the 49,000-plus copies I’ve sold.